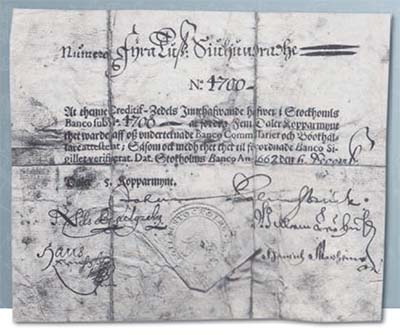

Sweden and Europe's First Banknote

The earliest European banknote most collectors will ever see was issued in Sweden in 1666, a happy coincidence given the anniversary we are now celebrating. The story of Europe's first banknote actually goes back even earlier and Sweden can make a technical claim to being the first country in the world to issue bank notes, on the grounds that the paper money issued in China from the 11th to 13th centuries was issued not by a bank but by the Emperor's treasury, as a substitute for cumbersome quantities of coin.

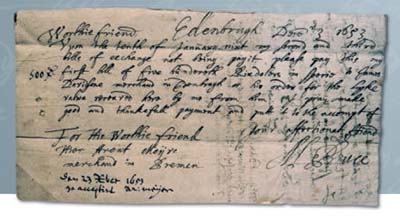

This article will focus on Sweden's pioneering paper money issues but will also seek to place this historic development in the context of their times. While paper was not used for any circulating medium prior to the Swedish issues, it was widely used across Europe to evidence and secure commercial transactions including transfers of land and property, most usually in the form of bills of exchange. Some government debt issues were also evidenced by paper.

HISTORICAL BACKGROUND

Banks had existed in Europe for at least three hundred years with the first ones appearing in Florence in the 14th century. Lombardy in northern Italy, with Florence at its centre, became home to several leading banks and the wide reach of their operations gave the name to Lombard Street in the heart of the City of London. The Banca Monte dei Paschi di Siena, founded in 1472, survives to this day as the oldest continually operating bank in the world after more than a remarkable 540 years in business, but as the Lombards declined as their political backers faded, so the Fuggers of Augsburg rose on the back of the spread of the vast Hapsburg Empire. Banking in its earliest days was essentially a case of rich merchants lending to kings and princes for often considerable profit but also rather too often considerable risk. How do you get your money back from a powerful monarch who decides to default?

|

PALMSTRUCH AND THE HISTORY OF STOCKHOLMS BANCO

Banking had changed by the 17th century, with clients now more likely to be traders and other merchants rather than royalty and this is the landscape into which Sweden's story fits. It starts on 30th November 1656 when Johan Palmstruch was granted a royal privilege to found a bank in Stockholm. The country was in some financial difficulty at the time thanks to extravagant spending by Queen Christina, the daughter of Gustavus Adolphus, not to mention the huge costs of the Thirty Years War which had only ended in 1648. But new wars flared up between Sweden and Poland and then Denmark with one result being that the prevailing copper currency, in the form of cumbersome plate money, began to devalue. Sweden, as Europe's leading copper producer, had adopted this metal for its currency because of its limited access to the gold and silver used by other countries. But copper plate money, first introduced in 1644, was large and heavy (it seems quite extraordinary to consider that some pieces weighed nearly 20 kilograms each!) and was not denominated in high enough amounts to make their use in anything other than the smallest transactions practical.

Hence the plan to establish a bank and for that bank to issue paper money representing the bulky lumps of metal people had to deal with. Plans had first been drawn up some time before Palmstruch's venture got off the ground, with the Swedes looking towards other early public banking ventures elsewhere in Europe such as the Banco de Rialto and the Banco del Giro, both in Venice, as well as the Bank of Amsterdam, for a suitable model. Private Banks already existed in several cities across the continent but what was desired was one owned and controlled by the state.

|

Palmstruch himself had had a chequered career prior to 1656. Little seems to be known about his early life but we do know he was born in Riga on 15th July 1611, possibly to a Dutch mother, at a time when Sweden controlled Livonia (now modern day Latvia). He was originally called Johan Wittmacher but changed his name to Palmstruch when he was ennobled in 1651. In 1635 at the age of 24 he had moved from Riga to Amsterdam where he set up as a merchant. Unfortunately he was arrested and imprisoned in 1639 for failing to pay his debts. The circumstances are not fully clear as he had always claimed to have sufficient assets in Holland but it still took him five years to achieve his freedom. One theory is that he was an economic spy targeting the Bank of Amsterdam. He certainly drew on his considerable knowledge of that institution when he set about establishing his own bank.

In 1647 he returned to Sweden and became a commissioner at the National Board of Trade. Having seen the Bank of Amsterdam in operation he started to put proposals together to set up a similar bank in Stockholm. His first ideas were rejected but when he came up with a plan to set up a bank which would be privately owned (by him and his partners) but would promise to pay half its profits to the Crown, approval was forthcoming. He received a Royal Letter of Appointment to confirm his position as a director of the bank while the Chancellor of the Exchequer was appointed as the bank's Chief Inspector. Effective state control, if not ownership, was established from the outset. With this structure Stockholms Banco (or Bank of Stockholm) opened its doors for business in July 1657 from a building near the Royal Palace. The bank opened branch offices in Gothenburg, Åbo (now Turku in Finland) and Falun, near Sweden's main copper mines.

In many ways the bank was no different from those in Amsterdam and elsewhere: deposits were taken and loans were made. Palmstruch used deposits taken from the public to finance loans but also took deposits from other sources including the Crown's customs revenues which were first paid to the bank before being transferred to the Crown. Unfortunately a fundamental fact of banking life had not been taken into account: taking in short term deposits to fund longer term loans could quickly create a liquidity problem for the bank if any of those deposits were withdrawn at short notice. This basic banking fact is one which banks over the decades and centuries have failed to heed, all the way down to the present day: this is exactly what brought down Northern Rock in 2007.

|

A currency depreciation in 1660 was the immediate spur to the issue of banknotes although at that time other forms of paper money were already in circulation due to the cumbersome nature of the copper plate money. These included paper, essentially receipts, issued by the government's Exchange Department for the deposits they had been taking. Cashier's notes and promissory notes from various issuers also circulated but none could be described as banknotes and few if any survivors of these early financial instruments can be found today.

Much of Sweden's copper plate money had been deposited at Stockholms Banco. When the plates began to depreciate in 1660 and new plates were prepared weighing about 83% of the old ones (measured in the daler silver money in which they were denominated), customers descended on the bank to get their old plate money back because this could now be melted down for a profit. Palmstruch could see his bank's business evaporating and proposed the issue of 'kreditivsedlar', or credit notes, initially for a transitional period only. He had first put this idea forward in 1652 but it had not been adopted.

This time, to ensure the concept was widely accepted, he proposed making the notes legal tender. After some discussion with the government it was decided not to go this far and that they should be issued to circulate 'natura sua', or of their own accord, i.e. without formal legal backing leaving people free to accept them or not. Their validity as currency would depend on people's confidence in the paper.

It was decreed that the kreditivsedlar would be exchangeable at any time for gold and silver coins and following the historic first issue on 16th July 1661 they began to circulate successfully. Europe's first banknotes had now been created. Initially all went well but in due course it became apparent the bank had been issuing more than it could afford to honour and, in 1668, the bank collapsed. All its loans had been paid out in the form ofkreditivsedlarand too many had been granted. Palmstruch had been pressured to grant a number of loans to influential members of society who were in no hurry to repay them. Moreover it transpired that the bank had been issuing notes not backed by loans to customers and had over-extended itself.

As early as 1663 the bank encountered liquidity problems when it found itself unable to honour withdrawals or make payments to the government. A commission was set up in November 1664 to investigate and after considering the situation for over two years concluded in March 1667 that the bank's poor standards of bookkeeping were at the heart of the problem. Palmstruch was charged with irresponsible accounting and with not having the cash to repay the credit notes due to miscalculations and omissions in his book-keeping. He was made personally liable for all the outstanding notes but was unable to make up the shortfall and in 1668 was sentenced to the loss of his title, loss of his banking privilege and eternal exile or death. The King of Sweden commuted the death penalty and Palmstruch was instead imprisoned. He remained in prison until 1670 and died the following year at the age of 60.

By John Calloway